When looking at Rental Market 2025, the nationwide landscape of rental pricing, supply, and tenant‑landlord dynamics for the year 2025. Also known as 2025 Rental Landscape, it reflects how economic shifts, policy changes, and lifestyle trends shape where and how people rent. This market rental market 2025 encompasses a mix of rent‑increase regulations, no‑fee rental models, and shifting demand for different property types.

One of the biggest drivers is Rent Increase Regulations, state and local rules that dictate how much and how often landlords can raise rent. For example, Virginia’s notice periods and caps directly affect tenant budgeting, while other states let rents rise freely. These rules influence the overall price ceiling of the rental market and force landlords to balance revenue goals with legal compliance.

Another hot trend is the rise of No‑Fee Rentals, listings where tenants avoid broker commissions and pay only the landlord’s rent. The no‑fee model lowers upfront costs for renters and pushes brokers to earn through alternative streams like spreads or order flow. This shift changes how tenants plan their move‑in budget and how landlords market their units.

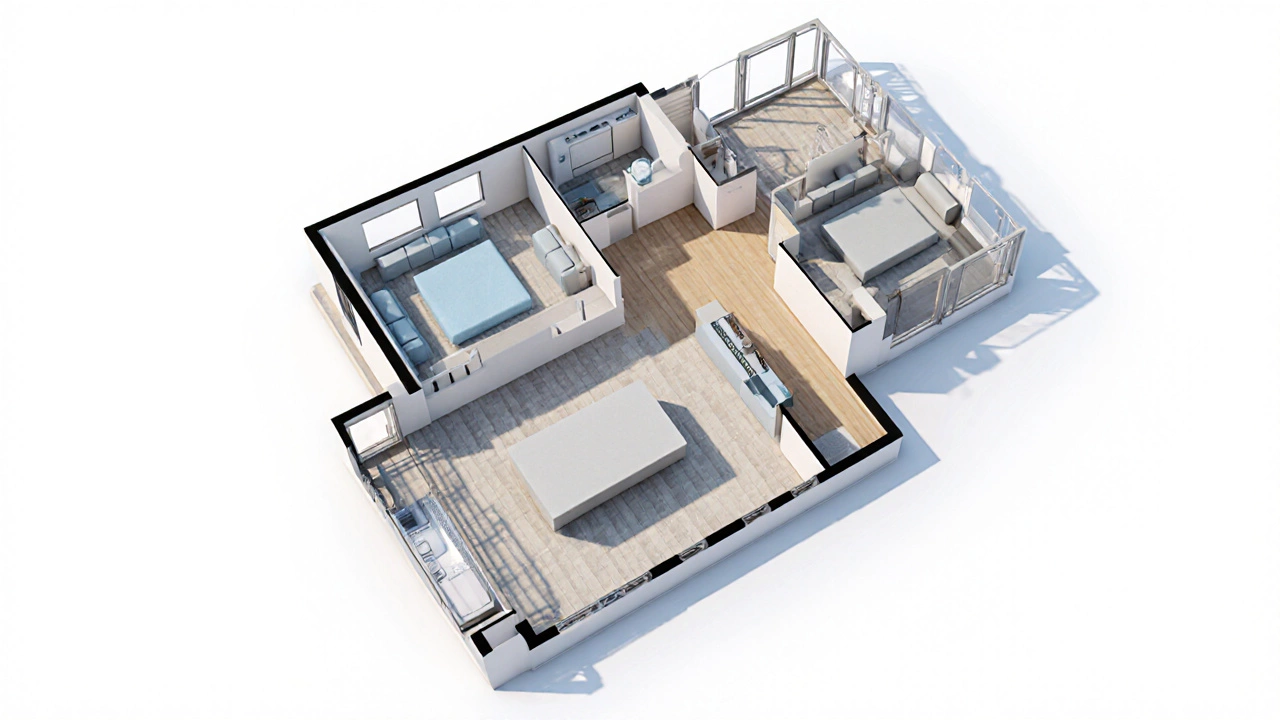

What you rent matters, too. Rental Property Types, the categories of homes – from 2BHK flats and studio apartments to villas or townhouses – each come with distinct price points and space trade‑offs. In 2025, smaller units like 600‑800 sq ft apartments dominate urban cores, while larger villas attract families in suburban pockets. The profitability of each type hinges on local demand, amenities, and the tenant’s willingness to pay premium for location or layout.

Affordability remains a cross‑cutting concern. The combination of rent‑increase rules, no‑fee options, and property‑type selection determines whether a city ranks as “cheap to rent” or “pricey.” States like Texas often show lower average rents, but the cost‑per‑square‑foot varies widely between city centers and outlying towns. Understanding these layers helps renters spot genuine bargains versus inflated listings.

The rental market also interacts with broader financial tools. Commercial loan down‑payment requirements and the 2% rule for investment properties shape how landlords acquire and manage units. When financing becomes tighter, landlords may pass costs onto renters, reinforcing the importance of staying on top of regulation changes and no‑fee opportunities.

Finally, technology plays a subtle role. Search engines for commercial real estate listings, AI‑driven pricing tools, and platforms that highlight no‑fee apartments streamline the hunt for the right home. These tools reduce friction, but they also generate new data points that influence market pricing dynamics.

All these pieces – rent‑increase laws, no‑fee models, property‑type trends, affordability metrics, and financing conditions – weave together to form the fabric of the Rental Market 2025. Below you’ll find articles that dive into each of these angles, offering practical tips, real‑world examples, and step‑by‑step guides to help you navigate the year’s rental landscape with confidence.

Learn what a 2K apartment means in Adelaide listings, typical sizes, rent ranges, and tips for finding the right two‑bedroom unit in 2025.