Mortgage Affordability Calculator

Calculate Your Monthly Payment

Estimate your mortgage payments before starting your online home search. Input your desired home price and financing details to see what you can afford.

Your Estimated Monthly Payment

Principal & Interest: $0

Property Taxes: $0

Home Insurance: $0

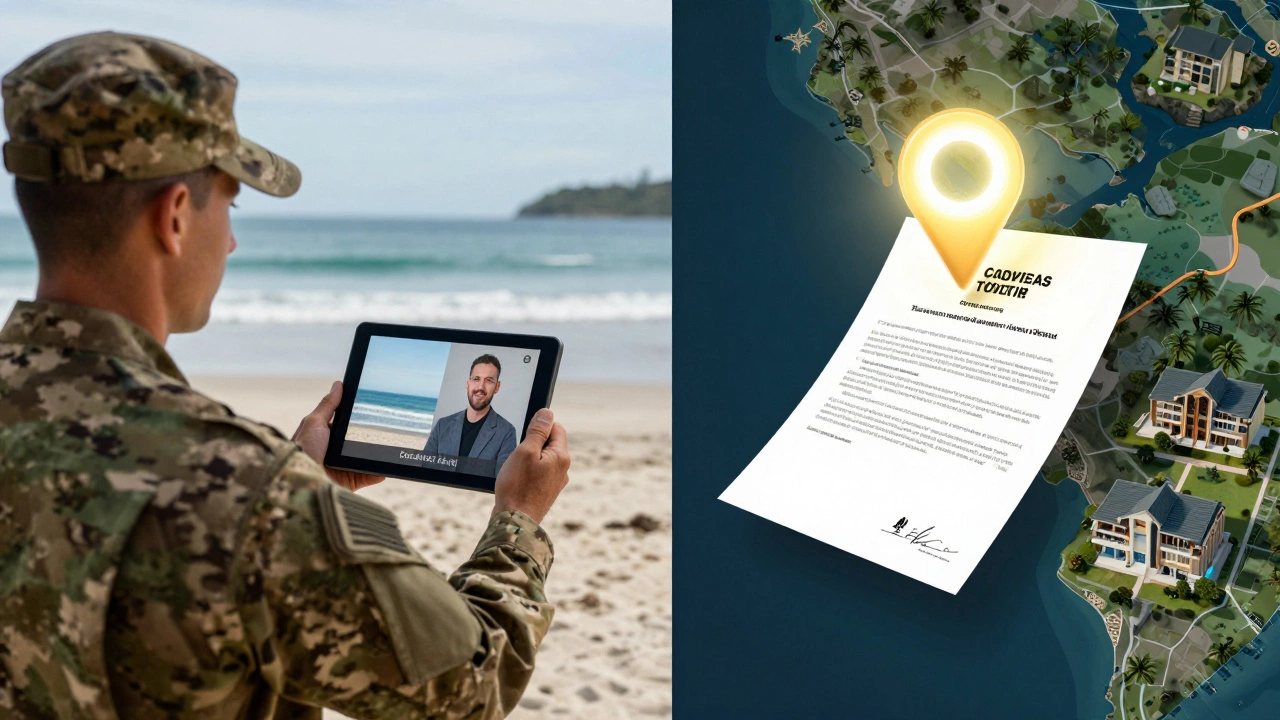

You can buy a house over the internet - and more people are doing it than ever before. In 2025, nearly 40% of home purchases in the U.S. started entirely online, with over 15% completed without a single in-person visit. This isn’t just a trend for tech-savvy millennials. It’s becoming the new normal for busy professionals, military families relocating, and even retirees moving across the country. The old idea that you need to tour every room, shake hands with an agent, and sign papers in a dusty office? That’s fading fast.

How Online Home Buying Actually Works

Buying a house online doesn’t mean clicking "Buy Now" like you would on Amazon. It’s a structured, step-by-step process that blends digital tools with trusted human support. Here’s how it breaks down:

- Search and filter - You use online platforms like Zillow, Redfin, or Realtor.com to filter homes by price, school district, commute time, and even flood risk. Some sites now show 3D walkthroughs, drone footage, and real-time listing updates.

- Virtual tours - Most listings include 360-degree video tours. You can pause, zoom in on the kitchen backsplash, or check if the backyard gets sun all afternoon. Some platforms even offer live virtual walkthroughs with an agent via Zoom or FaceTime.

- Pre-approval and financing - You can get pre-approved for a mortgage online in under 24 hours. Lenders like Rocket Mortgage and SoFi use automated underwriting to review your income, credit, and debt in minutes, not weeks.

- Offer and negotiation - Your agent submits the offer electronically. Counteroffers happen via email or secure portals. E-signatures are legally binding in all 50 states thanks to the ESIGN Act.

- Closing - You can close remotely. Title companies now offer mobile notaries, digital document packages, and even video notarization. In some states, you can sign your closing documents from a hotel room or while sitting on a beach in Costa Rica.

It’s not magic. It’s just better technology and smarter processes. The biggest change? You’re in control. You decide when to look, how much to offer, and whether to meet anyone in person.

What You Can’t Do Online (And What You Still Need)

Just because you can buy online doesn’t mean you should skip every human step. Some things still need a physical presence - or at least, a smart workaround.

- Home inspections - You can’t inspect a roof leak from your couch. But you can hire a licensed inspector and get a full report with photos and videos. Many buyers now watch the inspection live via video call.

- Appraisals - The lender still needs an official appraisal. Most are done in person, but some lenders now accept drive-by or desktop appraisals for low-risk areas.

- Local knowledge - No algorithm can tell you if the neighbor’s dog barks all night, or if the new highway expansion will cut through the park next year. That’s why working with a local agent is still critical - even if you never meet them face-to-face.

The smartest buyers use online tools for efficiency and local experts for context. You’re not replacing people - you’re upgrading how you work with them.

Real Examples: Who’s Buying This Way?

Take Sarah, a software engineer in Seattle. She was relocating to Austin for a new job. She didn’t have time to fly out for viewings. So she:

- Used Redfin’s 3D tours to narrow down 12 homes in her budget

- Hired a local agent to do a live walkthrough of the top 3

- Got pre-approved online in 8 hours

- Submitted her offer via e-signature

- Closed from her laptop in a hotel room three days before her move-in date

Or James, a veteran in Florida. He bought a condo in Colorado while stationed overseas. He never set foot in the state before closing. He used a virtual tour platform, a licensed inspector he hired remotely, and a title company that handled everything digitally. He got the keys via mail.

These aren’t outliers. They’re examples of how common this has become.

Pros and Cons of Buying a House Online

| Pros | Cons |

|---|---|

| Speed: Closings can happen in under 30 days. | Limited sensory info: You can’t smell the mold or hear the traffic noise. |

| Access: You can browse homes in any state, anytime. | Trust issues: Fake listings and scams still exist - especially on lesser-known sites. |

| Transparency: Price history, tax records, and neighborhood data are all in one place. | Legal complexity: Some states have stricter rules for remote closings. |

| Cost savings: Fewer travel expenses, faster deals, lower agent fees in some cases. | Emotional disconnect: It’s harder to feel "this is home" without walking through it yourself. |

The key? Know your priorities. If speed and convenience matter most, online buying is ideal. If you need to feel the space, test the faucets, or check the insulation with your own hands, plan for at least one in-person visit.

Red Flags to Watch For

Not every online listing is legit. Here’s what to watch out for:

- Too-good-to-be-true prices - If a home in a hot market is listed 20% below comparable sales, it’s probably a scam.

- No verified agent info - Always check the agent’s license number on your state’s real estate board website.

- Pressure to wire money fast - Legitimate closings never demand upfront payments via wire transfer before signing documents.

- Missing documentation - If you can’t access the property disclosure, inspection report, or title history, walk away.

Stick to major platforms with verified listings. Use escrow services. And always talk to a licensed real estate attorney in the state where you’re buying - even if you never meet them in person.

What’s Next? The Future of Online Home Buying

The next leap? AI-powered home matching. Some platforms are already testing tools that ask you 10 questions - "Do you want a backyard? Are you okay with older wiring? Do you need room for a home office?" - and then suggest homes that match your lifestyle, not just your budget.

Blockchain-based title transfers are being tested in a few states. Imagine signing your deed on a digital ledger that can’t be altered. No more lost paperwork. No more title insurance delays.

And in 2026, expect more states to allow fully remote closings. Arizona, Texas, and Florida already let you notarize documents over video. More will follow.

The future of buying a home isn’t about going to an office. It’s about having the right tools, the right team, and the confidence to make a big decision without stepping foot inside.

Can you buy a house online without seeing it first?

Yes, you can legally buy a house without ever seeing it in person. Thousands of people do it every year, especially military families, remote workers, and investors. But it’s risky without proper safeguards. Always use a licensed local agent, get a full inspection report with photos and video, review the property disclosure, and never skip title insurance. Most buyers who skip in-person visits end up regretting it - not because of fraud, but because of hidden issues like noise, lighting, or neighborhood feel that photos can’t capture.

Is online home buying safe?

Online home buying is safe if you use trusted platforms and licensed professionals. Stick to major sites like Zillow, Redfin, or Realtor.com. Never send money to someone you haven’t verified. Always confirm your agent’s license through your state’s real estate board. Use escrow services for deposits. And make sure your closing is handled by a reputable title company with a physical office and reviews. Scams exist, but they’re rare when you follow basic due diligence.

Do you need a real estate agent to buy online?

You don’t legally need an agent, but it’s strongly recommended. A good local agent knows the neighborhood, can help you interpret inspection reports, negotiate repairs, and spot red flags you might miss. Many agents now work remotely - they’ll video call you, send you documents, and handle paperwork online. You’re not paying for an office visit; you’re paying for expertise and local insight. Without one, you risk overpaying, missing repairs, or getting stuck with a property that doesn’t meet your needs.

Can foreigners buy a house online in the U.S.?

Yes, foreigners can buy property in the U.S. online. There’s no law requiring U.S. citizenship. Many international buyers use online platforms to search, hire a local agent remotely, and close via video notarization. The main challenges are financing - most lenders require a U.S. credit history - and taxes. You’ll need to understand U.S. property tax rules and possibly hire a U.S.-based accountant. Some buyers use cash or get loans from international banks with U.S. branches.

What’s the fastest way to buy a house online?

The fastest path is: 1) Get pre-approved online (Rocket Mortgage, SoFi), 2) Use a platform with verified listings and instant tours (Redfin, Opendoor), 3) Hire a local agent who specializes in quick closings, 4) Skip non-essential inspections if you’re buying a new construction or recently renovated home, and 5) Choose a state with remote closing laws (like Texas or Florida). In ideal conditions, you can go from first viewing to closing in under 20 days. But rushing increases risk - most experts recommend at least 30 days for due diligence.