Cash Back Value Calculator

Enter property details above to see results.

When you’re buying or selling commercial property, every dollar counts. So when someone says you’ll get 2 percent cash back on the sale, it sounds like free money. But is it really? Or is it just a shiny wrapper on a deal that might cost you more in the long run?

What Does 2 Percent Cash Back Actually Mean?

Cash back in commercial real estate isn’t like the 1 percent you get on a credit card. It’s a rebate-usually offered by a broker, developer, or sometimes even the seller-paid to the buyer after closing. If you buy a $5 million warehouse and get 2 percent cash back, that’s $100,000 in your pocket after the deal closes.

That sounds amazing. But here’s the catch: that $100,000 doesn’t come from nowhere. It’s often built into the price. The seller might have raised the sale price by $100,000 just so they could give it back to you as a rebate. That means you’re financing the rebate through your loan, paying interest on it, and possibly overpaying for the asset.

Why Do Sellers Offer Cash Back?

Sellers don’t give away money out of kindness. They use cash back to make a deal look better. Think of it like a discount coupon that only works if you buy the full-priced item.

In commercial real estate, buyers often compare properties based on price per square foot or cap rate. If two buildings are nearly identical, but one offers 2 percent cash back, the one with the rebate looks cheaper-even if the actual sale price is higher. It’s psychological pricing, the same tactic used in retail.

Also, sellers might use cash back to attract buyers in slow markets. Or they might be trying to move a property that’s been on the market too long. The cash back isn’t a bonus-it’s a tool to close a deal that might otherwise fall through.

Who Usually Offers Cash Back?

Most cash back offers come from one of three places:

- Brokers: Some brokers offer a portion of their commission back to the buyer as an incentive. This is legal in most states if disclosed properly.

- Developers: Especially with new construction or repurposed buildings, developers may offer cash back to speed up sales.

- Sellers: Rare, but possible-especially if they’re motivated or have financing tied to the sale.

Brokers offering cash back is the most common. But here’s what most buyers don’t realize: if your broker is giving you 2 percent back, they’re likely reducing their own commission. That means they might not be working as hard for you. A broker who makes less money on your deal has less incentive to negotiate aggressively, dig into inspections, or push for repairs.

Is 2 Percent a Lot? Let’s Compare

Let’s put 2 percent in context. In commercial real estate, standard broker commissions range from 4 to 6 percent of the sale price, split between buyer’s and seller’s agents. So if you get 2 percent back from your agent, you’re getting half their entire commission. That’s a big chunk.

But compare it to other incentives:

- Lease concessions: In office or retail deals, landlords often give 3-6 months of free rent. That’s far more valuable than a one-time cash rebate.

- Repair allowances: A $100,000 repair credit lets you upgrade HVAC, roofing, or electrical systems-things that add real value.

- Lower purchase price: A $100,000 reduction in the sale price means lower loan amount, lower monthly payments, and less interest paid over time.

Here’s the truth: 2 percent cash back is rarely the best deal. It’s the easiest to understand. But it’s often the least valuable.

When 2 Percent Cash Back Actually Makes Sense

There are real cases where 2 percent cash back is smart:

- You need immediate working capital: If you’re buying a property to renovate and flip, or you need cash to cover tenant improvements, that $100,000 can help you start faster.

- The price is truly fair: If you’ve done your due diligence and the property is priced at market value, and the cash back is extra, then yes-it’s a win.

- You’re paying cash: No mortgage means no interest on the rebate. You get the full $100,000 without paying more over time.

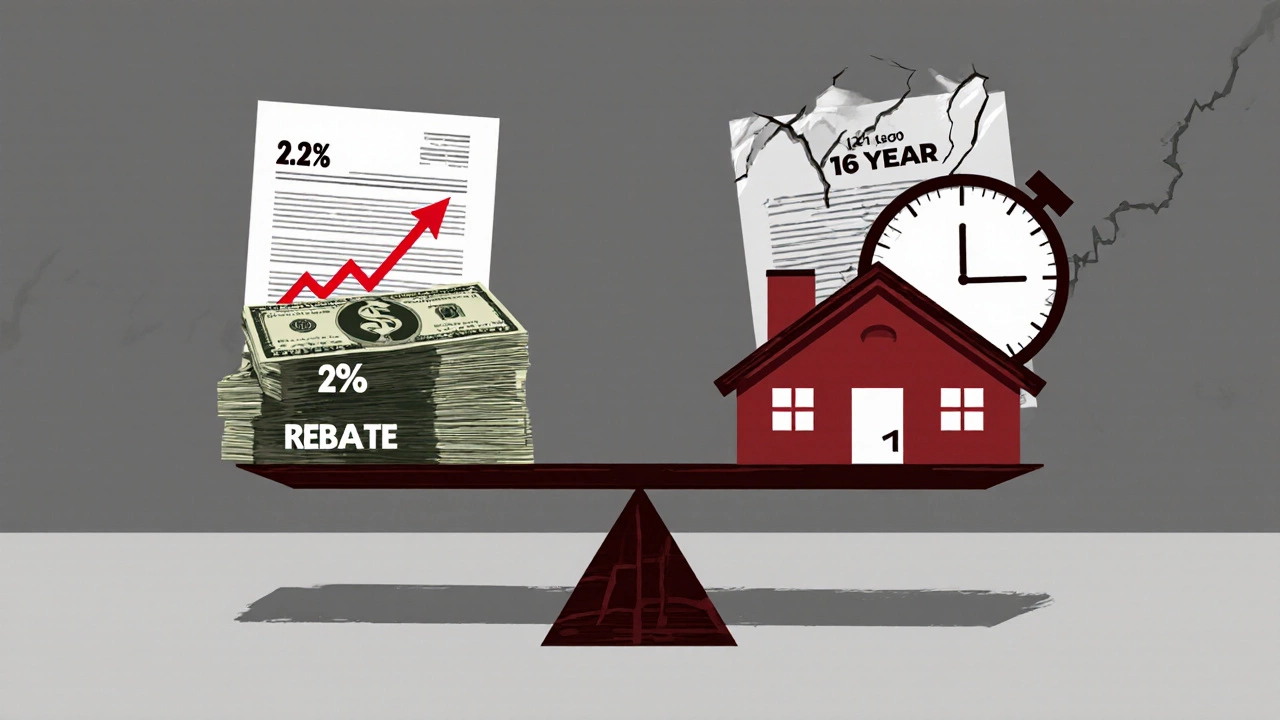

But if you’re financing the purchase, you need to run the numbers. Let’s say you buy a $5 million property at 2 percent cash back, but the price is actually $5.1 million. You put 30 percent down ($1.53 million), and finance $3.57 million at 6.5 percent over 25 years. Your monthly payment is about $24,200. If you’d bought it for $5 million with no rebate, your loan would be $3.5 million, and your payment would be $23,700. You’re paying $500 more per month just to get $100,000 back. It takes you over 16 years to break even. And that’s before taxes, insurance, and maintenance.

Red Flags to Watch For

Here are signs the cash back offer isn’t what it seems:

- The seller won’t let you get an independent appraisal.

- The broker refuses to disclose their commission structure.

- The property has hidden issues-outdated systems, zoning restrictions, or environmental concerns.

- The cash back is offered only if you use their preferred lender or attorney.

- You’re pressured to close within 30 days.

If any of these happen, walk away. Cash back is a tool, not a guarantee of value.

What to Do Instead

Instead of chasing cash back, focus on these three things:

- Get a professional appraisal: Know the true market value before you negotiate.

- Negotiate a lower price: A $100,000 discount beats a $100,000 rebate every time.

- Ask for tenant improvements or repair credits: These add long-term value to the property.

And if you’re working with a broker who offers cash back, ask: "If I didn’t get the rebate, would you still be willing to sell this at the same price?" If they hesitate, the rebate is masking a bad deal.

The Bottom Line

Is 2 percent cash back a lot? In dollar terms-yes. In value terms-not always.

It’s not inherently good or bad. It’s a tactic. And like any tactic, it only works if you understand how it’s being used. Most buyers get excited by the rebate and forget to check the fine print. Smart buyers ask: "What’s the real price? What’s the real value? And what am I really paying for?"

If you’re buying commercial property, your goal isn’t to get cash back. It’s to own a property that earns you money. That means paying the right price for the right asset-not chasing the biggest rebate.

2 percent cash back? It’s a nice bonus-if the deal is already good. But never let it be the reason you make the deal.

Is 2 percent cash back on commercial property legal?

Yes, it’s legal in most U.S. states as long as it’s fully disclosed to all parties, including the lender. Brokers must report cash back rebates on closing statements. Some lenders require written confirmation that the rebate doesn’t inflate the purchase price. Always consult your attorney or title company to ensure compliance.

Can I get 2 percent cash back on residential property too?

It’s rare and often restricted. Most residential lenders don’t allow cash back rebates because they worry it inflates the sale price and increases loan risk. Some states ban it outright for single-family homes. Commercial deals have more flexibility because the transactions are between sophisticated parties with higher risk tolerance.

Does cash back affect my loan approval?

It can. Lenders look at the purchase price, not the rebate. If the price is inflated to include the rebate, your loan-to-value ratio could suffer. Some lenders require a signed affidavit confirming the rebate doesn’t affect the property’s appraised value. Always tell your lender upfront about any cash back arrangements.

Should I use a broker who offers cash back?

Only if they’ve proven their value. A broker who gives you cash back might be cutting their own commission, which could mean less effort on your behalf. Ask for references, check their track record, and compare their service to brokers who don’t offer rebates. The best broker doesn’t give you cash back-they get you the best deal.

How do I calculate the real cost of a 2 percent cash back deal?

Step 1: Get an independent appraisal. Step 2: Compare the appraised value to the sale price. Step 3: If the sale price is higher than the appraisal, the difference is likely the hidden cost of the rebate. Step 4: Calculate your monthly loan payment with and without the rebate. If the payment is higher after the rebate, you’re paying more over time than you’re getting back.